Global Pension Market

Are you Ready?

Pension in Changing Times

Pension providers around the world are feeling pressured to radically change their fundamental pension systems, as the laws and regulations governing second and third pillar pension benefits continue to evolve in response to changing demographic profiles and economic conditions.

Keeping up with these changes and requirements in the financial services industry requires a flexible and scalable solution for pension providers' business operations; especially their IT infrastructures, to support their day-to-day operations and reporting obligations.

Challenges in the Pension Industry

As a result of low interest rates, pension providers are confronted with rising premiums and reduced profits on long-term investments. Administration costs also increase due to inflexible systems scattered over multiple sources that do not provide the real-time information required in today's market.

Pension providers must constantly adapt their processes and IT systems to keep pace with changes in the market, legislative and regulatory. But outdated and inflexible IT systems make it costly to launch new pension products, or enhance existing ones by adding individual and risk-based riders. The same also applies to the implementation of new regulations and legislation, such as an increasing retirement age. Not to mention the shift towards customer centricity and individualization that motivates employers to provide self-service kiosks to members, which provides consumer access to the whole EU through electronic distribution channels.

Let us show you a better way...

Scalable and Flexible Pension Solutions

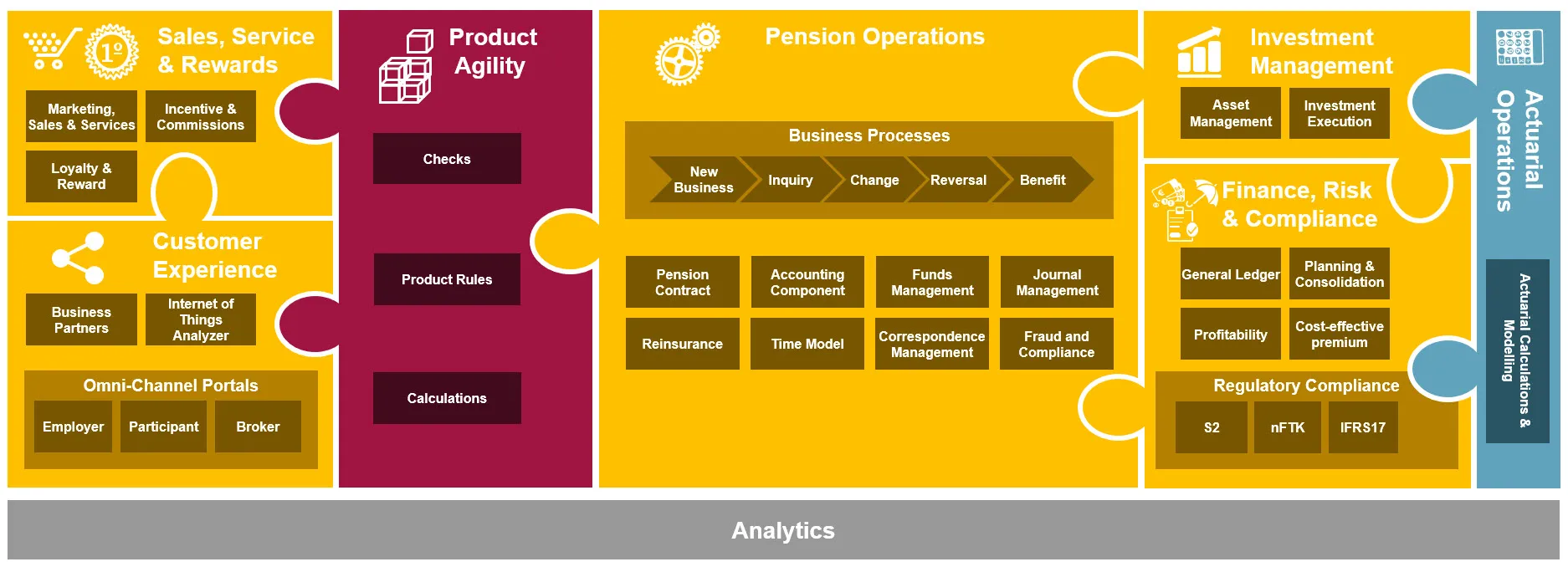

Are you interested in a well-engineered and modern end-to-end solution for the financial services industry with specific enhancements for the insurance and pension fund segments? We can help you implement solutions that are scalable to accommodate the growing retirement market and respond efficiently and cost-effectively to internal and external changes affecting the delivery of customer value.

With functionality that includes complete account histories, complete and transparent retention of all journal entries, and the ability to precisely perform retroactive changes (undo/redo), our pension solution provides important capabilities for the business departments that are typically not used by pension providers today.

The solution employs modern technology with a:

- component-based architecture;

- centralized product development for cross-platform distribution;

- powerful tools for straight-through processing and data migration.

The state-of-the-art, open architecture of our pension solution fully supports the orchestration and automation of process-flows and enables providers the ability to optimize their operations.

msg global solutions provides deep pension-market expertise and offers a flexible pension solution that has been designed to fit the Global Pension Market.

With the Financial Services Accelerator for the SAP Digital Portal Technology, SAP fully supports the focus on customers, whether they're employers, employees, or even brokers. This Portal Technology facilitates multi-channel marketing requirements in conjunction with commerce requirements, including a common base for any offer calculation out of the core administration in the mid- or back-office.

Pension Landscape

Faster Time-to-Market with Building Blocks

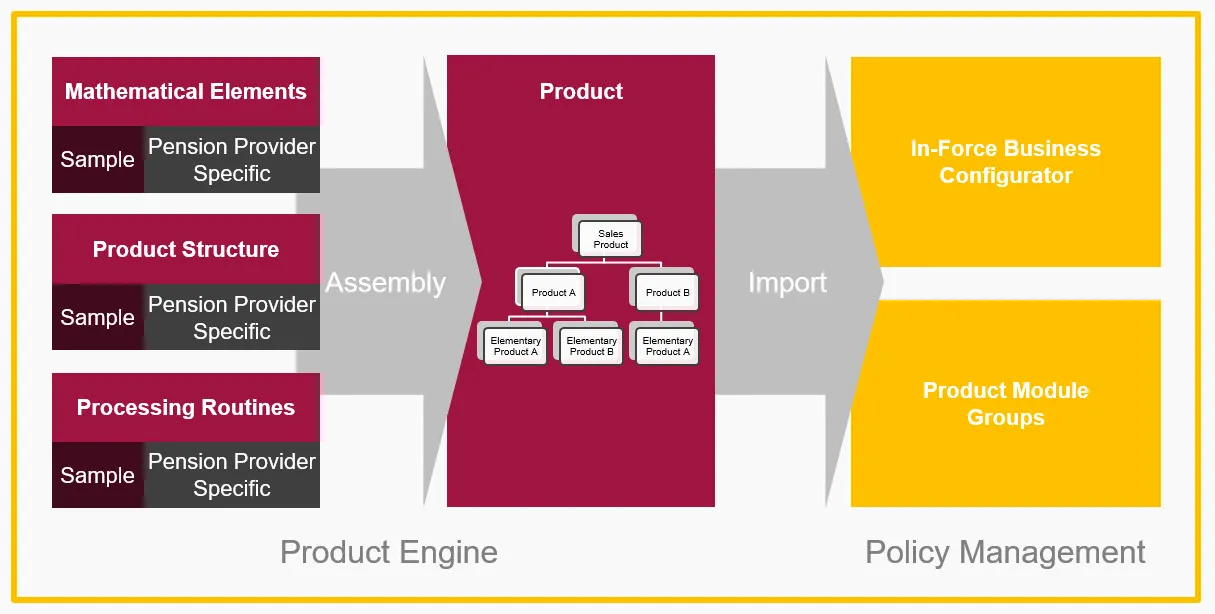

The pension market is constantly evolving, and pension administrators must have the tools to get new products to market quickly. msg global solutions has developed a tailored product configuration that uses a building-block approach to increase time-to-market and easily convert product testing into product management.

Products in the msg product engine are assembled by using "building blocks" — reusable, granular components that are used to compose new products. This means that when a product behaves in a similar way as an already implemented product, only the delta needs to be built.

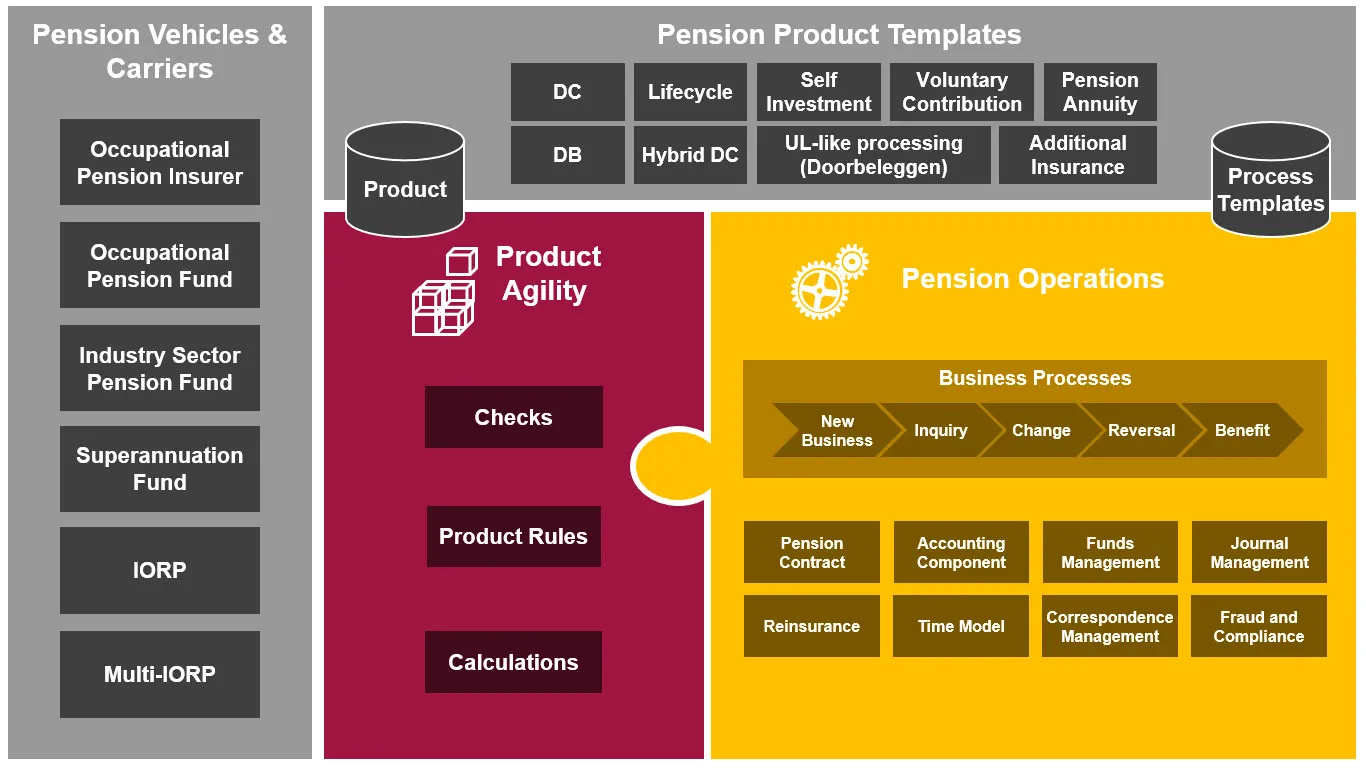

Pension Templates

Our template approach allows you to cater to different market segments from individual to group pension plans, both in your domestic as well as international market — all provided by a single platform.

msg global solutions can help you develop a solution platform to manage your pension products.

The configuration of pension products in the product engine follows our comprehensive template approach, which enables reuse across products as well as markets.

You maintain common characteristics and functionality of your pension products in one spot while having the flexibility of individual enhancements to your particular market demands.

References

Largest International Insurance Group in Central and Eastern Europe

Largest International Insurance Group in Central and Eastern Europe

- Implementation of a Premium Pension product for the Austrian market

Top Pension Insurer in the Netherlands

Top Pension Insurer in the Netherlands

- Implementation and integration of an end-to-end solution for core pension insurance processes for DB, DC and hybrid DC products on one instance.

- Implementation of immediate annuity and term life insurance products.

- High-level standard of functionality and automation.

Large General Pension Fund in the Netherlands

Large General Pension Fund in the Netherlands

- Hybrid bank & pension implementation

- Configuration of preceding and subsequent General Pension investment shift processes

- Design and implementation of ring-fenced participant administration

- Financial situation calculation and projection at retirement age for participant portal

Get in Touch

Contact Rob to learn more about how msg global solutions can help you design a scalable, flexible pension management solution.