Contextual data enrichment for motor risk

assessment with msg.AMI

Context matters

Driving behavior data can be misleading without the right situational context.

Enhance your motor risk model with msg global's Augmented Mobility Index (msg.AMI), which offers context-aware intelligence for more accurate risk assessment, clearer premiums to policyholders, and actionable insights that facilitate targeted driving coaching.

The challenge: uncovering hidden risk

Failure to slow down is a hidden risk invisible to traditional telematics programs. Sophisticated players (fleet operators or insurers) are resorting to hardware like dashcams to pick up contextual clues.

With msg.AMI we democratize this hidden risk and allow every insurer to detect it without the need to buy or install additional hardware. Using the signal from a standard telematics program hidden risk is revealed: no added complexity, no new hardware, just valuable insights.

Built by actuaries and data scientists, msg.AMI:

- Detects and enriches telematics trips

- Produces explainable, contextualized driving behavior events

- Empowers pricing or data science teams to boost predictive accuracy

Context is all you need

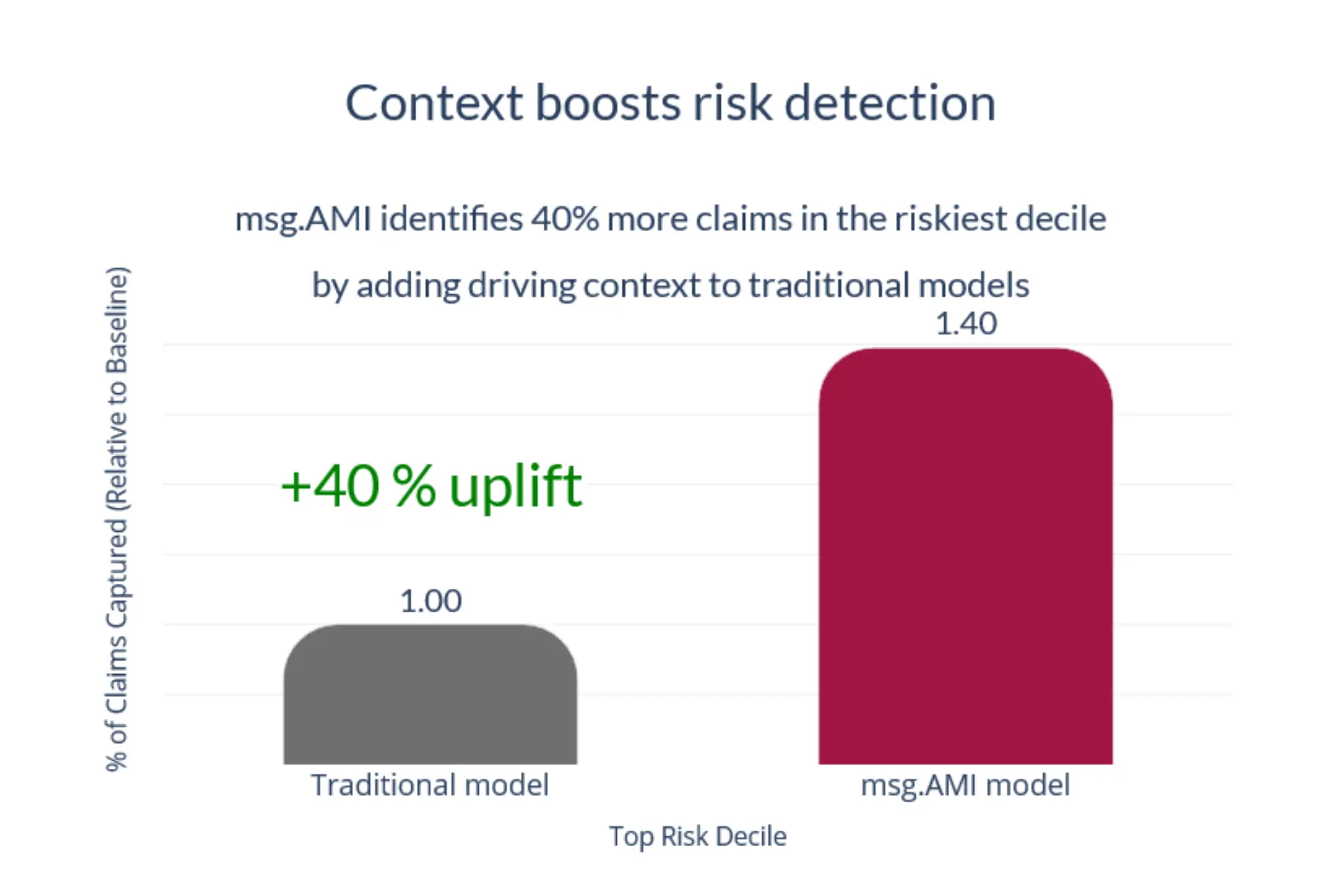

Context-enriched models identify 40% more claims among the riskiest policyholders compared to a standard telematics approach.

By integrating contextual data, our model significantly boosts the concentration of predicted claims within the highest-risk decile, which is where accurate prediction matters the most. This enhanced segmentation is critical for more accurate pricing and improved profitability of the telematics program.

Use cases

A practical example

A driver commutes to work and is enrolled in a motor telematics program. On this trip, there’s no harsh braking or speeding, so the trip receives a perfect score: 100%.

However, when the insurer enriches the same trip data using the msg.AMI API, a different picture emerges. The driver failed to slow down at a yield, an event that traditional telematics completely missed. What appeared to be smooth driving was, in fact, risky behavior.

Without context, the insurer misclassifies the trip. With msg.AMI, the hidden risk is revealed, leading to more accurate scoring and better risk assessment.

Insurers can supercharge their motor telematics dataset with contextualized driving events and unique predictive power thanks to msg.AMI.

If an insurer would like to start a new telematics program, we can support the project end-to-end with our AI mobility platform.

Fleet operators benefit from deeper insights into driver behavior with msg.AMI. By layering contextual intelligence onto traditional telematics, operators can monitor risk more accurately and deliver targeted coaching that improves safety, performance, and compliance.

How it works: choose your option

Option 1

Static portfolio enrichment. Enrich one data batch, ideal for testing and creating a business case.

Option 2

Post-trip enrichment. Continuously process your telematics data, access enrichment services via API to feed risk assessment, driver scoring, and loss prevention measures.

Benefits of msg.AMI:

- Context-enriched driver behavior

- Additional risk segmentation

- More accurate costing

- Smarter pricing

- Better loss prevention

- Higher profitability